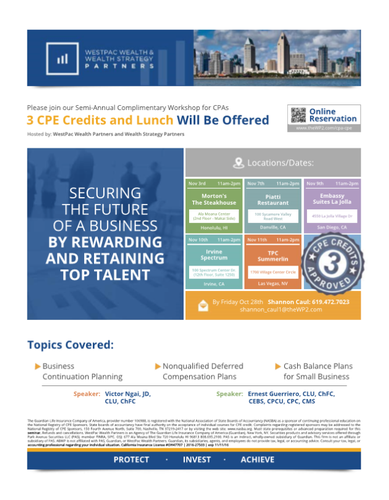

CPE Seminar - Lunch & Learn - 3 CE Credits

Name:

CPE Seminar - Lunch & Learn - 3 CE Credits

Date:

November 7, 2016

Time:

11:00 AM - 2:00 PM PST

Event Description:

Hello! WestPac Wealth Partners is hosting our bi-annual CPE seminar. New to NorCal, we're looking to build a long lasting relationship with our community. CPAs, do you work with successful small business owners? We're covering topics on business continuation planning for small business owners as well as non-qual deferred compensation plans for their top management team. In addition, are your business owners projected to pay a high tax bill for 2016? A cash balance plan will help defer beyond $53,000 ($59,000 catch-up), if appropriate for said business owner. Many CPAs learned a new topic at our last seminar: IRS Code Section 101(j). The code requires employer owned life insurance contracts to have a signed Notice and Consent and the annual filing of Form 8925 in order to qualify for exceptions to the general rule under this code section. Lack of compliance could significantly impact the tax consequences of the life insurance proceeds from these contracts. 3 CE credits and lunch will be provided.